Horngren’s cost accounting 17th edition – Embark on a journey into the realm of cost accounting with Horngren’s 17th Edition, the definitive guide to understanding and applying cost accounting principles. This comprehensive textbook provides a solid foundation for students and professionals alike, equipping them with the knowledge and skills to effectively manage costs, make informed decisions, and drive organizational success.

Throughout this exploration, we will delve into the fundamentals of cost accounting, examining the different types of costs and their significance. We will explore the various cost accounting systems and their advantages and disadvantages, guiding you in selecting the most appropriate system for your organization.

Moreover, we will delve into the intricacies of cost allocation and assignment, empowering you to accurately distribute costs to products or services.

1. Cost Accounting Fundamentals

Cost accounting is a branch of accounting that focuses on the recording, classification, and analysis of costs. It provides information that helps managers make informed decisions about the production and sale of goods and services.

Types of Costs

- Direct costs: Costs that can be directly traced to a specific product or service.

- Indirect costs: Costs that cannot be directly traced to a specific product or service but are necessary for the production or sale of goods and services.

- Fixed costs: Costs that do not change with the level of production or sales.

- Variable costs: Costs that change with the level of production or sales.

Importance of Cost Accounting

Cost accounting is essential for businesses because it provides information that can be used to:

- Set prices for products and services

- Make decisions about product mix

- Control costs and improve profitability

Examples of Cost Accounting in Various Industries

Cost accounting is used in a wide variety of industries, including:

- Manufacturing

- Retail

- Healthcare

- Education

2. Cost Accounting Systems: Horngren’s Cost Accounting 17th Edition

There are three main types of cost accounting systems:

Job Costing

Job costing is a system that tracks costs for each individual job or project. This system is typically used in industries where products are produced in batches or on a custom basis.

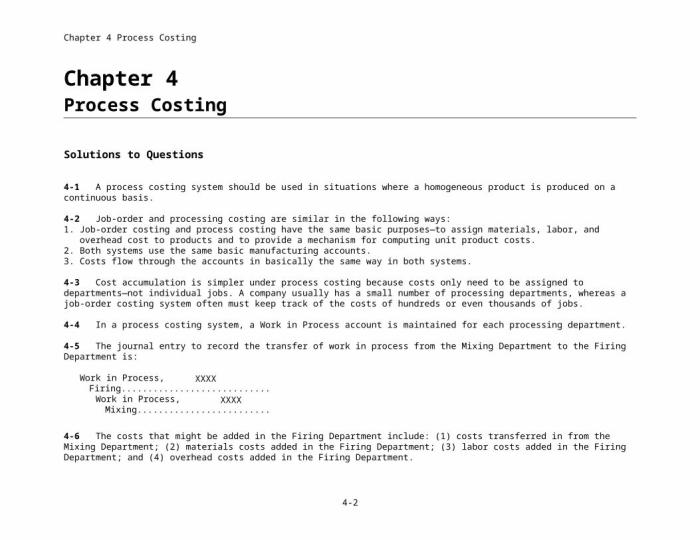

Process Costing

Process costing is a system that tracks costs for each production process. This system is typically used in industries where products are produced in a continuous flow.

Activity-Based Costing

Activity-based costing (ABC) is a system that tracks costs for each activity that is performed in the production or sale of goods and services. This system is more complex than job costing or process costing, but it can provide more accurate information about the costs of products and services.

Advantages and Disadvantages of Each System

| Cost Accounting System | Advantages | Disadvantages |

|---|---|---|

| Job Costing | Accurate cost information for individual jobs or projects | Complex and time-consuming |

| Process Costing | Simple and easy to use | Less accurate cost information for individual products |

| Activity-Based Costing | Most accurate cost information | Complex and time-consuming |

Factors to Consider When Selecting a Cost Accounting System

- Type of industry

- Size of the business

- Complexity of the products or services

3. Cost Allocation and Assignment

Cost allocation and assignment are two methods that are used to assign costs to products or services.

Cost Allocation

Cost allocation is the process of assigning indirect costs to products or services. This process is typically done using a cost driver, which is a factor that causes costs to change.

Cost Assignment

Cost assignment is the process of assigning direct costs to products or services. This process is typically done using a specific identification method, such as the first-in, first-out (FIFO) method.

Types of Cost Pools and Cost Drivers

- Cost pools: Groups of costs that are allocated to products or services using a common cost driver.

- Cost drivers: Factors that cause costs to change.

Examples of Cost Allocation and Assignment in Practice

- Allocating overhead costs to products based on the number of direct labor hours

- Assigning direct material costs to products based on the quantity of materials used

4. Cost Analysis and Control

Cost analysis and control are two important aspects of cost accounting.

Cost Analysis, Horngren’s cost accounting 17th edition

Cost analysis is the process of examining costs to identify trends and patterns. This process can be used to identify areas where costs can be reduced.

Cost Control

Cost control is the process of implementing measures to reduce costs. This process can involve a variety of techniques, such as:

- Setting budgets

- Monitoring costs

- Implementing cost-saving initiatives

Importance of Cost Variance Analysis

Cost variance analysis is a technique that is used to compare actual costs to budgeted costs. This analysis can be used to identify areas where costs are out of control.

Examples of Cost Analysis and Control in Various Organizations

- A manufacturing company that uses cost analysis to identify areas where it can reduce its overhead costs

- A retail company that uses cost control to reduce its inventory costs

5. Cost Reporting and Disclosure

Cost reporting and disclosure are two important aspects of cost accounting.

Types of Cost Reports and Disclosures

- Cost of goods sold

- Selling, general, and administrative (SG&A) expenses

- Income statement

- Balance sheet

Importance of Cost Reporting and Disclosure

Cost reporting and disclosure are important for both internal and external stakeholders.

- Internal stakeholders: Cost reporting and disclosure can be used by managers to make informed decisions about the production and sale of goods and services.

- External stakeholders: Cost reporting and disclosure can be used by investors, creditors, and other external stakeholders to assess the financial health of a company.

Examples of Cost Reporting and Disclosure in Practice

- A company that includes its cost of goods sold in its income statement

- A company that discloses its SG&A expenses in its financial statements

6. Advanced Cost Accounting Topics

Cost accounting is a complex and challenging field. However, there are a number of advanced cost accounting topics that can be used to improve the accuracy and effectiveness of cost accounting systems.

Use of Cost Accounting in Decision-Making

Cost accounting can be used to make a variety of decisions, such as:

- Pricing decisions

- Product mix decisions

- Investment decisions

Role of Cost Accounting in Continuous Improvement and Lean Manufacturing

Cost accounting can be used to support continuous improvement and lean manufacturing initiatives. These initiatives can help companies to reduce costs and improve quality.

Emerging Trends in Cost Accounting

There are a number of emerging trends in cost accounting, such as:

- Use of artificial intelligence (AI)

- Use of big data

FAQ Corner

What are the key benefits of using Horngren’s Cost Accounting 17th Edition?

Horngren’s Cost Accounting 17th Edition provides a comprehensive and up-to-date understanding of cost accounting principles, enabling readers to make informed decisions, optimize resource allocation, and improve profitability.

Who should use Horngren’s Cost Accounting 17th Edition?

This textbook is an invaluable resource for students, accountants, managers, and business professionals seeking to enhance their knowledge and skills in cost accounting.

What are the key updates in Horngren’s Cost Accounting 17th Edition?

The 17th Edition incorporates the latest advancements in cost accounting practices, including the use of technology, data analytics, and emerging trends in the field.